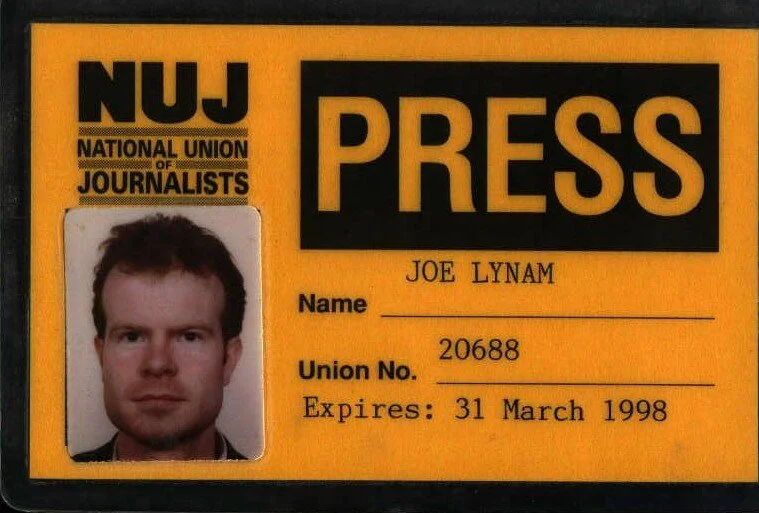

TRANSCRIPT

NT - 2706 Michael McGrath FULL LENGTH EDITED

Joe: [00:00:00] we are about two weeks away from the end of the so-called 90 day pause, which Donald Trump.

Yeah. Uh, institute. Um, and there are a lot of talks. I know your colleague Maros Sefcovic, is in deep talks on with the American administration. Um, there's a huge amount of time pressure. I just wonder where we are with this and just how serious is this because. If the pause ends and these huge tariffs come in for European exporters, it could have a devastating impact.

Michael: Uh, this is extremely serious. And, and first of all, Joe, thanks for the opportunity to, to have a chat with you. And, uh, I'm in direct contact with a lot of Irish exporting businesses and they're explaining the consequences, uh, in real life for them, of even the tariffs that apply at the moment. Let alone where the tariffs might go if we're not able to reach an agreement.

So we are negotiating on behalf of the European Union. I had a good discussion with Commissioner Sefcovich [00:01:00] earlier this week. He knows the extent of what is at stake here, not just for Ireland, but throughout the European Union. Uh, but there is strength in the collective, and it is good that the negotiations are being done by the European Commission on behalf of the block of 27.

Member states because that gives us real power and real force, and we are making the point strongly to our American counterparts that you know, in broad terms, this is a balanced trade relationship. When you take goods and services into account in the context of a 1.7. A trillion Euro annual trade. Uh, the, the overall balance in favour of the EU is, is about 50 billion.

So it's very, very low overall. So it's quite a balanced relationship and where there are issues in terms of the global trading system, and we acknowledge there are including, uh, excessive subsidies from certain countries, including China over capacity. Then the EU in the US should be working together on those issues.

Um, but overall, the, [00:02:00] the EUUS trading relationship is the most important in the world. And it has been without question enormously, mutually beneficial. And so we wanted to continue. And the businesses I'm talking to above all else, they want certainty, they want predictability. So we need to get through, uh, the next couple of weeks and hopefully deliver that to them, uh, so that they can plan, uh, the running of their businesses for the months and years ahead.

Joe: Donald Trump doesn't really take the European Union seriously. he hasn't had a of an EU US Summit. He was in Europe this week. He completely bypassed Brussels. He was a hop and a skip away in the Hague. it's gonna be very difficult for him 'cause he likes to have one-on-one conversations with individual member states, which he can bully, whereas he potentially can't bully the European Union.

It won't be easy to get this over the line because the Americans said their base. Case is a 10% tariff on everything coming in to America from Europe.

Michael: Yeah, none of this is easy now. Uh, it has to be said. President Trump and President [00:03:00] Van der Leyen have had a number of interactions and he has brief spoken positively about her, uh, recently.

So that's good. And look, the important thing here is the substantive negotiations that are underway and the US side know that we are. Uh, we are a serious outfit, the European Union. We are acting, uh, as a block and we are conducting these negotiations robustly, uh, but professionally and in good faith. And there have been very few leaks.

If you actually look at, uh, what has come out in recent weeks and months, it's very tight and that's good, uh, because there's so much at stake and a lot has been put on the table that's been widely reported. Not just tariffs, but non tariffs. And we have to work our way through all of this and come to a settlement.

And ultimately that is, uh, what is needed because there are millions of jobs on both sides of the Atlantic that are on the line here, and we need to get this right. And while it may not be possible to have a fully fledged comprehensive trade agreement in less than two weeks time. [00:04:00] We can at least move to a better place where we have, uh, stable and predictable terms of trade, even if additional detail has to be worked out.

Later on

Joe: in January, you promised to prosecute social media giants if they amplified content, which steered a political discussion or even elections. We've had since then elections in, uh, in Germany, Poland, Romania, and one social media owner (Elon Musk) even openly supported a far right AFD party - appearing at a rally.

And yet there's been no action taken against these social media giants, these American, mostly social media giants. Uh, it does appear to some as if the commission are afraid. To prosecute some of these companies, lest it upset someone in the Oval Office?

Michael: Well, there are formal actions underway, and if you look across the full, uh, digital rule book and the legislation that the EU has put in place, whether it be the Digital Services Act, which you're referring to the Digital Markets Act, the AI Act, GDPR, [00:05:00] various actions have been taken, including the, the imposition of very large fines recently.

On multinational companies under the Digital Markets Act. But to your specific question, under the DSA, there are obligations on these platforms in relation to electoral integrity on that very question of the amplification of of certain content above other content, the use of algorithms and recommender systems.

And there are investigations underway, but they have to take their course. The DSA is a very powerful tool that we have to ensure. That the, the parties that we are taking actions against, uh, have a right to due process, have a right to respond and provide evidence. But there are various investigations underway in respect of consumer protection and product safety matters, uh, child protection, uh, issues, uh, and also of course in the, uh, in the digital market space, uh, as well, there are actions that are underway, uh, and, uh, those will continue, those will take their [00:06:00] course.

And, uh, we will find con and reach conclusions based on the evidence that we have, and it won't be influenced by, uh, the geopolitics. Uh, this has to operate on a standalone basis. This is the eus Digital Rule book, and, uh, it is our right to bring it forward, and it is our duty to implement it.

Joe: The DSA, the Digital Services Act and Digital Markets Act, were passed by 27 different governments. Is there a chance that as part of these wider trade negotiations that. Bit of the DSA could be diluted, curtailed, paused even to get a wider settlement with the Americans?

Michael: Look, we have been clear that our focus here is on trade. It is on, uh, tariffs, but he will want concessions. Um, he, he will, of course, and, uh, the US have, it's no secret put, uh, a range of non tariff barriers as they would call them, uh, on the record and on the table in respect of these negotiations.

But I think we can respond and. Be [00:07:00] clear that these instruments are applied, um, evenly and objectively to companies, whether they be American companies, European companies, or Chinese company, or any Chinese companies like TikTok. So, so there'll be no compromises on DSA,

Joe: so it won't be negotiated away.

Michael: Well, later on this year, um, the executive vice president has promised to bring forward a digital omnibus and it will look at simplification measures rather than deregulation.

And it will look at, uh, the, uh, interplay between business and digital regulation, but it is in the context of simplification, uh, and not winding back, uh, the rules that the European Union has brought forward. Okay.

Joe: Um, a huge part of your portfolio you've already mentioned is consumer rights. Um, would consumers here live with some sort of dilution of the food standards that would come into this country, come into this continent?

IE hormone treated American beef or chlorine washed beef as part of a trade deal, a wider, bigger trade deal.

Michael: We're very proud [00:08:00] of the food safety standards that we have in the European Union. Uh, those have been developed over many decades and we, uh, apply very significant resources at union and member state level, uh, to ensure that those rules and those standards are implemented, uh, and enforced.

And so the protection of the health of European consumers, uh, will always be of paramount importance and will be a priority. And, uh, that is not, uh, a negotiating tactic. That is something that, uh, we stand for and we will continue to implement. Uh, of course, if the US wish to put issues on the table, we engage, we listen to their concerns, uh, and uh, we will respond in the appropriate way.

But that does not involve a dilution of. Uh, of health and food safety standards within the European Union we're very proud of, of the standards we have and we intend to maintain them.

Joe: Um, as part of your justice portfolio, you're talking about something called the 28th regime. Now the Mario Draghi report [00:09:00] last September was almost damning in its criticism of how Europe was falling behind when it came to competitiveness.

But especially against the Americans, especially against the Chinese where regulation is far looser and diluted. Tell us about the 28th regime, which is supposed to make it easier for startups and scale ups, uh, and how. And when is it gonna come into force?

Michael: We're about to start, uh, the public consultation on the 28th regime.

There is a huge level of interest within the business community, entrepreneurs, those involved in startups, but also those wanting to scale up. And I meet many, uh, people in business who say to me, Michael, we'd love. To have Europe as our global base. Uh, we want to really scale up within Europe, but fragmentation is the problem, fragmentation of different systems around the 27 member states of the European Union.

So tackling that fragmentation is really at the heart of our competitiveness agenda as a European [00:10:00] commission. And one such instrument is the so-called 28th regime, which will be, uh, a simplified harmonized set of rules that will involve. Corporate law changes, uh, and if these characteristics are, are met, then companies can opt into this 28th regime and it will be fully recognized on a horizontal basis then, uh, throughout the European Union, making it much easier, uh, to navigate 27 different national systems and providing that platform.

For growth and for scaling up. So we will bring forward a detailed proposal, uh, early next year and, uh, I really look forward to bringing forward that project because I think it has enormous potential, uh, to help achieve greater scale for European businesses. We're doing well in startups, but too many, uh, startups that have huge potential are choosing to do their scale up phase elsewhere, particularly in the us.

And fragmentation is the main reason why.

Joe: There is a risk that there's lots of [00:11:00] legislation out there, commissioner and it, but it doesn't work 'cause it's blocked at a national level. And I'm thinking of the Capital Markets Union, which was supposed to be created almost 15 years ago. And it's not really worked.

You can't apply in Ireland for a mortgage in Luxembourg where the rates are much lower. Absolutely. Yeah. Uh, and then now you're talking about a savings union. Um, how will that work and how will that benefit companies and consumers?

Michael: So again, it's an example of fragmentation and it's an example of where.

We're not, uh, allowing ourselves to achieve the full potential that the single market offers us because we don't have a full single market, uh, in key parts of our economy, including in financial services at the moment. Uh, we have about 11 trillion euro, uh, of savings sitting in bank accounts in year early next to no interest at all, earning, little or nothing.

So we need to have, uh, more user friendly. Simpler investment products, uh, that can happen on a cross-border basis, and that we need to connect those [00:12:00] investments and that capital with the productive needs of the economy, including to European companies. And that is the essence of the Savings and Investments Union.

I sit on the, the project group, wondered Leadership of Commissioner Alberquerque. And yes, there will be national resistance, but if we're serious about. Uh, tackling the competitiveness deficit that has been allowed to build up over a number of decades in Europe. Issues like that have to be confronted, and so we're very ambitious in bringing forward the savings and investments union project.

Joe: What have you learned in your eight months, uh, in the job? Seven months in the job? Almost seven. Yeah. Yeah. In Brussels. That we could learn here in Ireland.

Michael: Well, I think it's, uh, it, it's the scale of the European Union that really comes home to you. The fact that you have 27 member states, uh, very diverse, uh, in nature, you have a complex decision making structure within the European Union.

I. We are the guardian of the treaties and the [00:13:00] commission. Uh, but we have to work with the coal legislators, the European Parliament, and of course the member states. Uh, initiatives generally start with the commission. We propose new laws and new policies. Uh, we seek agreement in the case of legislation with the coal legislators, but then we have to oversee.

The implementation, uh, and the enforcement, what I can say hand and heart is that Ireland is viewed very positively, uh, in Brussels, and it is seen as a country that is, um, very pragmatic, uh, very positive in its engagement with the European Union and a country that can be pointed to as a, a real success story, uh, that has made.

Uh, huge gains on the back of, of trade and availing of the benefits of the single market. So I think Ireland is well regarded. We now have, of course, even with our

Joe: very low corporation tax and our kinda outlier status with among some member states when it comes to Israel.

Michael: Uh, I think on corporate tax we've moved beyond that issue given all of the reforms that have been introduced, uh, in Ireland, [00:14:00] signing up to the OECD deal, which of course now is dead, has to operate in a different environment.

Uh, but Ireland has, uh, adopted a whole range of different reforms and has addressed, uh, legacy issues that needed to be addressed, and I would've brought forward in many of those reforms in. My time in the Department of Finance and in relation to Israel and Gaza. The truth is, as the has been speaking about in the last number of days, there simply isn't agreement within the European Union.

Uh, there are very divergent views. What, uh, all of the countries do agree on. Is the need for an immediate ceasefire, the need for humanitarian age to be allowed in rapidly. It needs to be flooded into Gaza given the scale of the humanitarian crisis, and there is agreement that the hostages should be released.

But beyond that, there isn't agreement among the 27 member states. And what is not often fully understood when people criticize to commission, for example, is that the common foreign insecurity [00:15:00] policy is. Governed by Article 24 of the, the treaty in the European Union. It's the preserve of the European Council.

They set, uh, the foreign policy of the European Union, and in general, they do so on the basis of unanimity. And so the commission cannot go beyond what is the agreed position of the European Union. And I think what the was referring to is, uh, the inability, the unwillingness. To reach a, a broader agreement and a deeper agreement as to what, uh, what needs to be done, uh, to resolve what is a horrendous situation, uh, in Gaza.

And, uh, and that is hugely frustrating. Uh, but what we have to do is try to make practical progress on the ground. Uh, and the most important thing is for, is for a ceasefire to take hold and for aid to be allowed in quickly because the crisis, uh, is just untenable. It's unconscionable what's happening there.

Joe: Final question. There's no chance of removing Vetos though, is there?

Michael: Well, that can only be done by agreement, uh, because, and referenda, uh, it, it would [00:16:00] involve treaty change. So I don't anticipate, uh, any, uh, early moves in that direction. Uh, there are inbuilt vetoes in certain, uh, decision making processes.

It can be challenging. We have a new EU budget to be negotiated, uh, again, that has to be signed off by all of the member states in dealing with the, the Russian invasion of Ukraine. Uh, the agreement on sanctions, the rollover of sanctions, uh, is governed by unanimity. So it's very, very challenging, but I don't, uh, envisage member states being willing to give up that right of veto anytime soon.

So I think we have to work with the system that we have, try to build consensus, uh, and try to move forward and make progress on behalf of the people of the European Union.